Vancouver, British Columbia: Calibre Mining Corp. (TSX-V: CXB) (the "Company" or "Calibre") is pleased to present assay results from a diamond drilling program completed on the Rosita D Concession, in northeast Nicaragua under an option agreement with Alder Resources Ltd. (TSX-V: ALR) ("Alder"). Calibre and Alder entered into an option agreement dated August, 2011 whereby Alder can earn a 65% interest in the 3,356 hectare Rosita D concession (the "Property") located within Calibre's 100%-owned Borosi concessions in northeast Nicaragua by expending a total of CDN$4.0 million on exploration on the property and by issuing to Calibre a total of 1,000,000 common shares of Alder over a 4 year period. Alder is the project operator

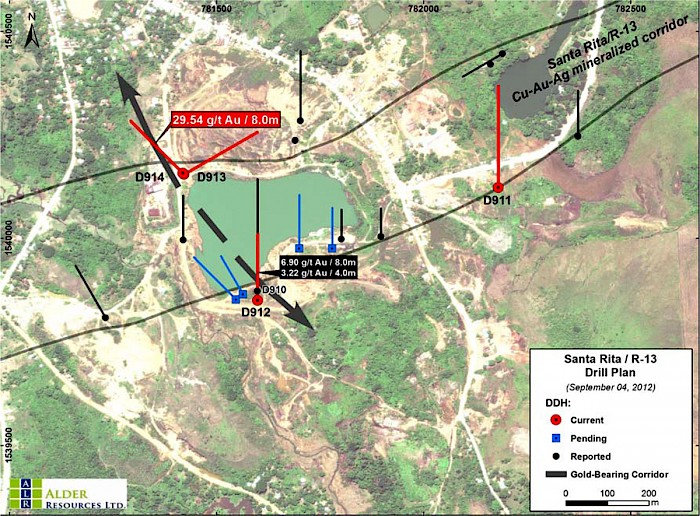

Located along the western side of the historic Santa Rita open pit (see figure 1) Alder drill hole D914 intersected 8.0 metres grading 29.54 grams per tonne ("g/t") gold ("Au") from 240 metres. The intercept includes a 2.0 metre interval from 241 metres, averaging 110.68 g/t Au, which is comprised of two, 1-metre segments assaying 139.29 g/t Au and 82.07 g/t Au, respectively. If cut to 30 g/t Au, the 8-metre interval grades 9.38 g/t Au. This high grade intercept occurs in garnetite skarn and skarn breccia, containing a stockwork of calcite+quartz+sulphide veinlets with visible gold noted locally in the drill core. The hole was drilled obliquely to the interpreted northwest trend and the true width of this intercept is unknown. Further drilling is required to delineate the geometry of this zone.

These results demonstrate the presence of bonanza grade gold values along a northwest-trending gold-bearing corridor. This mineralization is primarily gold with lesser amounts of silver and is distinct from the copper-gold-silver mineralization associated with skarn and diorite host rocks. Hole D914 is located 250 metres northwest of previously released hole D910, which intersected 65 metres of skarn mineralization grading 1.48 g/t Au from 50 metres, including 8.0 metres grading 6.90 g/t Au and 4.0 metres grading 3.22 g/t Au (see Alder press release, May 31, 2012). Hole D912, drilled below D910, returned two intercepts of 2.0 metres grading 1.45 g/t Au and 4.0 metres grading 1.76 g/t Au that correlate with the two higher grade intercepts in D910. Based on results to date, Alder management believes there is reasonable potential to define a high grade, northwest-trending gold zone in the same area that has historically produced skarn and porphyry-style copper-gold-silver mineralization and in the same area that Alder is working to define a skarn and porphyry-style copper-gold-silver resource (see Alder news release dated September 5, 2012).

High grade gold mineralization was also intersected in north-directed angle hole D911, located on the southwest side of the R-13 pit and 650 metres to the northeast of holes D910 and D912. There, a 6 metre interval from 173 metres intersected 1.86 g/t Au and a 1-metre interval from 290 metres returned 30.37 g/t Au, within a broader 3 metre zone from 289 metres assaying 0.80% copper ("Cu"), 10.45 g/t Au, and 21.83 g/t silver ("Ag"). The orientation of this high grade structure remains unclear, however, its location within a northwest-striking zone of mineralization identified in the 1970s (referred to as the R-13 West deposit), indicates that northwest-trending structures may have a greater influence in localizing precious metals than previously recognized. High grade gold values have been intersected in three of the fourteen core holes reported to date (D910, D911, and D914). A total of 18 core holes have been completed in the Phase One drill campaign at Santa Rita.

Alder plans to drill additional holes along the interpreted northwest-trending gold-bearing structural corridors flanking the Santa Rita pit, and also plans to test several prominent IP geophysical anomalies generated by a recently completed 79 line-kilometre survey. Alder's goal is to define both a gold-only and a gold-copper-silver bedrock resource that could compliment the current Inferred stockpile mineral resource of 7.95 million tonnes grading 0.62% Cu, 0.46 g/t Au and 9.20 g/t Ag (see Alder press release, May 9, 2012). Results for additional core holes are pending, including the first two at the Bambana prospect, located 4 kilometres northwest of Santa Rita.

Results for this and select other drill holes completed at Santa Rita are summarized in Table 1 and illustrated in Figure 1.

Table 1. Summary of diamond drill hole intercepts at Santa Rita/R-13 area.

|

Hole ID

|

Area

|

From

(m) |

To

(m) |

Core Length

(m) |

Cu

(%) |

Au

(g/t) |

Ag

(g/t) |

|---|---|---|---|---|---|---|---|

|

D911

|

R-13

|

173.0

|

179.0

|

6.0

|

0.05

|

1.86

|

3.15

|

|

|

and

|

289.0

|

292.0

|

3.0

|

0.80

|

10.45 uncut

|

21.83

|

|

|

|

|

|

|

|

10.33 cut

|

|

|

|

including

|

290.0

|

291.0

|

1.0

|

0.48

|

30.37 uncut

|

11.60

|

|

|

|

|

|

|

|

30.00 cut

|

|

|

D912

|

Santa Rita

|

156.0

|

158.0

|

2.0

|

1.24

|

1.45

|

12.25

|

|

|

and

|

197.0

|

201.0

|

4.0

|

0.03

|

1.76

|

0.09

|

|

D913

|

Sta Rita

|

low grade values

|

|

|

|

||

|

D914

|

Sta Rita

|

235.0

|

250.0

|

15.0

|

0.04

|

15.82 uncut

|

0.23

|

|

|

|

|

|

|

|

5.62 cut

|

|

|

|

including

|

240.0

|

248.0

|

8.0

|

0.04

|

29.54 uncut

|

0.29

|

|

|

|

|

|

|

|

9.38 cut

|

|

|

|

including

|

241.0

|

243.0

|

2.0

|

0.04

|

110.69 uncut

|

0.60

|

|

|

|

|

|

|

|

30.00 cut

|

|

Au cut to 30.0 g/t; Ag cut to 50.0 g/t. True widths are not known at this time.

Quality Assurance/Quality Control

All drill holes were collared using HQ-size drill core, and reduced to NQ-size where necessary. Core was loaded on-site into wooden core boxes and transported on a daily basis by Company personnel to Alder's secure field office in Rosita, where geologists logged the holes, and selected intervals for assay. Individual samples of drill core were sawed, using a 10" diamond blade trim saw. Half of the sample was retained in the core box, the rest loaded into a pre-numbered, heavy gauge plastic bag, sealed and then trucked on a weekly basis (by the lab or by Company personnel) to Inspectorate Exploration and Mining Services' preparation laboratory in Managua. There, pulps were prepared for shipping to Inspectorate's Analytical laboratory in Vancouver, where each sample was analyzed via fire assay for gold and for copper, silver and 28 other elements using ICP (inductively coupled plasma-atomic emission spectrometry) methods. Alder has implemented an industry standard Quality Assurance/Quality Control program that includes the insertion of certified standards and blanks into the sample stream.

Qualified Person

Mr. Gregory Smith, P.Geo, the President and CEO of Calibre, is the Qualified Person as defined by NI 43-101, and is responsible for the accuracy of the technical data and information contained in this news release.

About Calibre Mining Corp.

Calibre Mining Corp. is a TSX Venture Exchange listed company (TSX.V: CXB) that is focused on the acquisition, exploration and development of gold and silver deposits in Central America. The Company is focused on its 100% owned Riscos de Oro gold-silver deposit, the drilling program at the Primavera gold-copper project in conjunction with B2Gold Corp. and the drilling program on the Rosita copper-gold-silver project in conjunction with Alder Resources Ltd. Major shareholders of Calibre include gold producer B2Gold and investment fund Sun Valley Gold.

Calibre Mining Corp.

"Greg Smith"

Greg Smith, P.Geo.

President and CEO

For further information contact:

Mark Carruthers -- Vancouver, Canada

604 681 9944

www.calibremining.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.