On October 20, 2011 Calibre Mining Corp. ("Calibre") (TSXV: CXB) and Alder Resources (TSX-V: ALR) ("Alder") entered into an option agreement whereby Alder can earn a 65% interest in the 3,356 hectare Rosita D concession (the "Property") located within Calibre's 100%-owned Borosi concessions in northeast Nicaragua. Located within the Property is the historic Santa Rita open pit copper-gold mine and the Bambana copper-gold prospect.

Under the terms of the option agreement, Alder can earn a 65% interest in the Rosita D concession by expending a total of CDN$4.0 million on exploration and other work on the Property and by issuing to Calibre a total of 1,000,000 common shares of Alder over a 4 year period. Alder will be acting as the project operator for all work conducted on the Property during the option period with the first year exploration commitment being CDN$500,000. Upon Alder earning a 65% interest in the Property a joint venture will be formed with Calibre and Alder being responsible for their pro-rata share of all subsequent project expenditures.

Please see the Alder Resources Ltd News Release below.

TORONTO, ONTARIO - (Marketwire - May 31, 2012) -

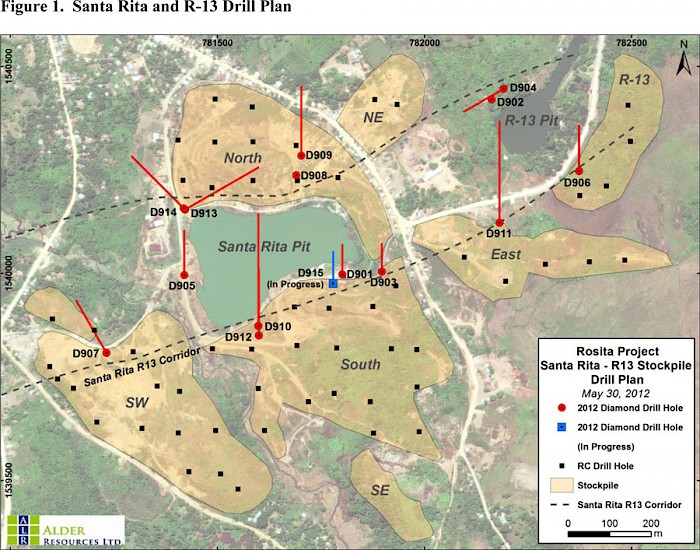

The drill rig is currently sited on the southeast side of the Santa Rita pit, approximately 200 metres east of hole D910, where it is testing a 1970s La Luz Mines intercept which returned an 18.3 metre (true thickness) interval grading 2.95% Cu, 3.2 g/t Au and 33.3 g/t Ag at 60 metres below the pit bottom. It is believed that this high grade intercept occurs within the same mineralized structural corridor that hosts mineralization in hole D910 and that drilling has now traced the corridor for approximately 1,100 metres from hole D907 through to hole D906. This mineralized corridor contains most of the historic resources on the Rosita property and will be the focus of in-fill drilling (See Figure 1).

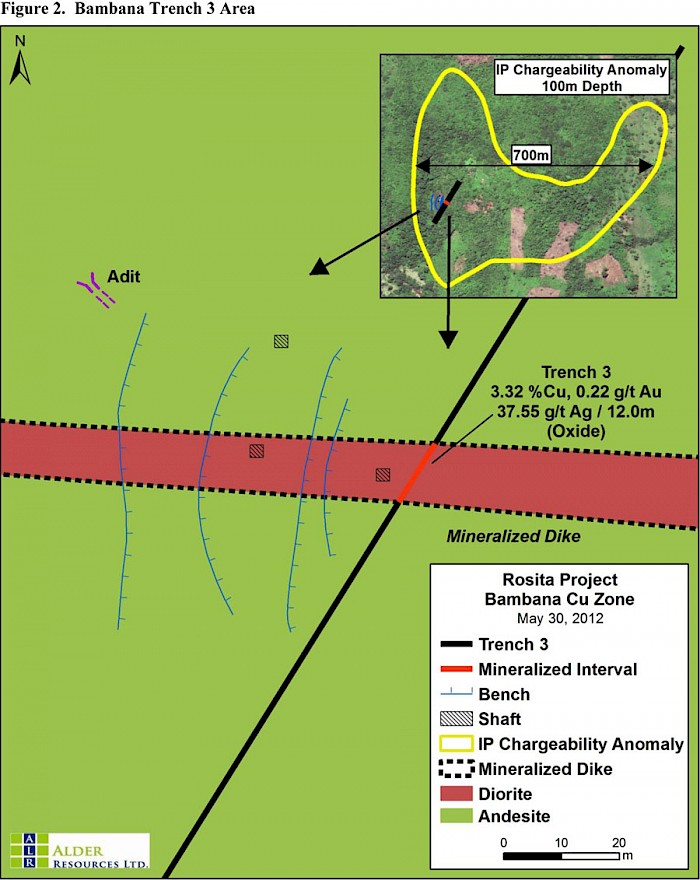

Alder will target the Bambana prospect next where exploration work has developed an exciting Cu-Au-Ag porphyry prospect. At Bambana, a 700 metre by 500 metre IP chargeability geophysical anomaly appears to be related to porphyry-type mineralization in a trench that returned 3.32% Cu, 0.22 g/t Au and 37.55 g/t Ag over 12.0 metres (See Figure 2). This target represents significant potential upside for Alder in addition to the Santa Rita and R-13 mineralized zones.

| Table 1. Rosita Drill Intercepts | ||||||||||||||

| Hole ID | Area | From (m) |

To (m) |

Thickness (m) |

Cu (%) |

Au (g/t) |

Ag (g/t) |

Zn (%) |

||||||

| D901 | Sta Rita | 75.0 | 85.9 | 10.9 | 0.36 | 0.15 | 6.32 | 1.05 | ||||||

| " | 89.0 | 92.0 | 3.0 | 0.12 | 1.27 | 3.57 | ||||||||

| D902 | R-13 | 39.0 | 45.0 | 6.0 | 0.18 | 0.17 | 3.45 | 0.08 | ||||||

| " | 61.0 | 77.0 | 16.0 | 0.32 | 0.66 | 12.49 | 0.29 | |||||||

| " | 153.0 | 161.0 | 8.0 | 0.38 | 0.04 | 3.71 | ||||||||

| D903 | Sta Rita | 109.0 | 110.0 | 1.0 | 0.01 | 0.33 | 9.00 | 1.62 | ||||||

| D904 | R-13 | 3.0 | 14.0 | 11.0 | 0.09 | 0.13 | 7.16 | |||||||

| " | 25.0 | 27.0 | 2.0 | 0.94 | 0.75 | 10.00 | ||||||||

| 52.1 | 53.0 | 0.9 | 3.33 | 0.40 | 40.10 | 0.23 | ||||||||

| " | 67.0 | 75.0 | 8.0 | 0.10 | 0.81 | 16.53 | 0.69 | |||||||

| " | 151.0 | 152.1 | 1.1 | 0.11 | 0.20 | 88.50 | 0.18 | |||||||

| " | 211.0 | 212.1 | 1.1 | 0.55 | 0.18 | 11.60 | 0.34 | |||||||

| D905 | Sta Rita | 215.8 | 217.3 | 1.5 | 1.02 | 0.69 | 2.88 | |||||||

| D906 | R-13 | 213.0 | 217.0 | 4.0 | 0.49 | 1.15 | 4.40 | |||||||

| D907 | Sta Rita | 43.0 | 67.0 | 24.0 | 0.09 | 0.15 | <0.1 | |||||||

| D908 | Sta Rita | Low Grade | ||||||||||||

| D909 | Sta Rita | Assays Pending | ||||||||||||

| D910 | Sta Rita | 50.0 | 115.0 | 65.0 | 0.20 | 1.48 (1.00 cut | ) | 2.00 | ||||||

| Including | 84.0 | 92.0 | 8.0 | <0.1 | 6.90 (3.03 cut | ) | <0.1 | |||||||

| and | 100.0 | 115.0 | 15.0 | 0.57 | 1.52 | 5.93 | ||||||||

| and | 106.0 | 110.0 | 4.0 | 1.46 | 3.22 | 15.25 | ||||||||

| D911 | R-13 | Assays Pending | ||||||||||||

| D912 | Sta Rita | Assays Pending | ||||||||||||

| D913 | Sta Rita | Assays Pending | ||||||||||||

| D914 | Sta Rita | Assays Pending | ||||||||||||

| D915 | Sta Rita | In Progress | ||||||||||||

| NB. Au values >10 g/t cut to 10 g/t. Thickness represents drilled width; true widths are unknown at this time. |

To date a total of 4,732 metres have been drilled in 15 holes, all in the Santa Rita/R-13 area. Assay results in this news release represent the first 3,144 metres in 9 holes of an 8,000 metre drill program for the Rosita project. The initial 5,000 metre campaign is centered on the historic Santa Rita and R-13 pits, where approximately 5.5 million tonnes of ore averaging 2.06% Cu, 0.93 g/t Au, and 15 g/t Ag were extracted by La Luz Mines (a subsidiary of

- Obtain basic geologic information to establish the controls for mineralization, the limits of skarn development and the extent of the volcanic-intrusive domains

- Selectively test historic mineralized intercepts

- Identify areas for follow up drilling that could add tonnage and complement the stockpile resource increasing the attractiveness of a potential commercial operation

The drilling is highlighted by hole D910, which returned a long interval averaging 1.48 g/t Au over 65 metres in garnet-quartz-calcite-epidote-pyrite-chalcopyrite skarn cut locally by mineralized veinlets and breccias which tend to boost precious metals grades. Included in this interval is a 15.0 metre section that returned 0.57% Cu, 1.52 g/t Au and 15.25 g/t Ag. Alder management has maintained that a significant tonnage of Cu-Au-Ag mineralization can be identified by exploring adjacent to and below the Santa Rita and R-13 pits. Alder believes discovery hole D910 and several narrower drill intercepts in the other core holes validate this hypothesis, and provide specific areas for follow-up investigations. The mineralization in hole D910 is open at depth and to the east. Hole D907, 400 metres west of D910, intersected a 24.0 metre interval of 0.15 g/t Au and 0.09% Cu and may represent the western continuation of the system. Additional drilling is required to determine the strike of the gold-copper zone.

Alder President and CEO,

Other highlights include drill holes D905 and D907 both of which intersected intervals of quartz-sulphide-magnetite veinlets in an altered diorite intrusive. Hole DDH 907 cut a 24 metre interval (from 43 m to 67 m) of veinlet stockwork which returned highly anomalous gold (0.15 g/t) and copper (0.09% Cu). Alder believes that follow up work in this area is warranted.

The Rosita project is located seven kilometres north of the Primavera prospect, where

In a news release dated

Drilling will now focus on the Bambana prospect where several IP anomalies have been delineated. Targets will be selectively drill tested. In addition, an IP-resistivity geophysical survey is nearing completion that has delineated several distinct chargeability anomalies, with 50.5 line-kilometres completed, representing approximately 72% of the proposed program. Chargeability anomalies are inferred to represent areas of disseminated sulphide mineralization that could represent porphyry-type exploration targets. Detailed geologic-alteration mapping at Bambana has been completed and trenching is planned across several of the stronger anomalies.

Quality Assurance/Quality Control

All holes are collared in HQ size drill core and reduced to NQ size where reduction is necessary. Core is transferred into wooden core boxes and transported on a daily basis by Company personnel to Alder's secure field office in Rosita, where geologists log the holes, and select intervals for assay. Individual samples of drill core are sawed using a 10" diamond blade trim saw. Half of the sample is retained in the core box, and the other half loaded into a pre-numbered, heavy gauge plastic bag, sealed then trucked on a weekly basis (by the lab or by company personnel) to Inspectorate Exploration and Mining Services' preparation laboratory in

Qualified Person

About

Alder is a resource company focused on the development of gold and base metal projects throughout

Alder entered into an option agreement to acquire a 65% interest in the Rosita D concession from

Alder intends to continue to build its property position with strategic acquisitions.

Alder Resources Ltd.

“Joseph Arengi”

Joseph Arengi

President & CEO

For further information, contact:

Alder Resources Ltd.

Joseph Arengi

416-309-4397

info@alderresources.ca

www.alderltd.ca

Cautionary Note Regarding Forward-looking Information

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information includes, without limitation, statements regarding potential mineralization, reserve and resource determination, exploration results and future plans. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Alder to be materially different from those expressed or implied by such forward-looking information, including but not limited to: general business, economic, competitive, geopolitical and social uncertainties; the actual results of current exploration activities; risks associated with operations in foreign jurisdictions; ability to successfully integrate the purchased properties; and other risks inherent in the mining industry. Although Alder has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. Alder does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.